Smart personal finance is essential for achieving financial security and reaching your life goals. It involves managing your money effectively, making informed decisions, and planning for the future. By taking control of your finances, you can reduce stress, increase your financial well-being, and achieve your dreams.

| Key Aspects of Smart Personal Finance |

| Budgeting: Creating a budget is the foundation of smart personal finance. It involves tracking your income and expenses to understand where your money is going. Benefits: Identifies areas where you can cut back spending. Helps you prioritize your financial goals. Provides a clear picture of your financial situation. | Saving: Saving money is crucial for building a financial safety net and achieving long-term goals. Benefits: Provides a cushion for unexpected expenses. Allows you to take advantage of opportunities. Helps you reach your financial goals faster (e.g., buying a home, retirement). |

| Investing: Investing your money allows it to grow over time and can help you achieve your financial goals more quickly. Benefits: Potential for higher returns than traditional savings accounts. Helps you reach long-term financial goals (e.g., retirement, education). Diversifies your income streams. | Managing Debt: Managing debt effectively is crucial for maintaining financial stability. High-interest debt can be a significant drain on your finances. Benefits: Reduces financial stress. Frees up money for other financial goals. Improves your credit score. |

Planning for the Future:

Planning for the future involves setting financial goals and developing strategies to achieve them. This includes retirement planning, estate planning, and insurance planning.

- Benefits:

- Ensures financial security in retirement.

- Protects your assets and loved ones.

- Provides peace of mind.

| Summary |

In conclusion, smart personal finance is essential for achieving financial security and reaching your life goals. By focusing on budgeting, saving, investing, managing debt, and planning for the future, you can take control of your finances and build a brighter financial future. Remember to start small, stay consistent, and seek professional advice when needed. Welcome to WordPress. This is your first post. Edit or delete it, then start writing!

Protect your financial well being and enjoy your peace of mind using legal documents from LawDepot

Some helpful personal finance tools from Amazon are below:

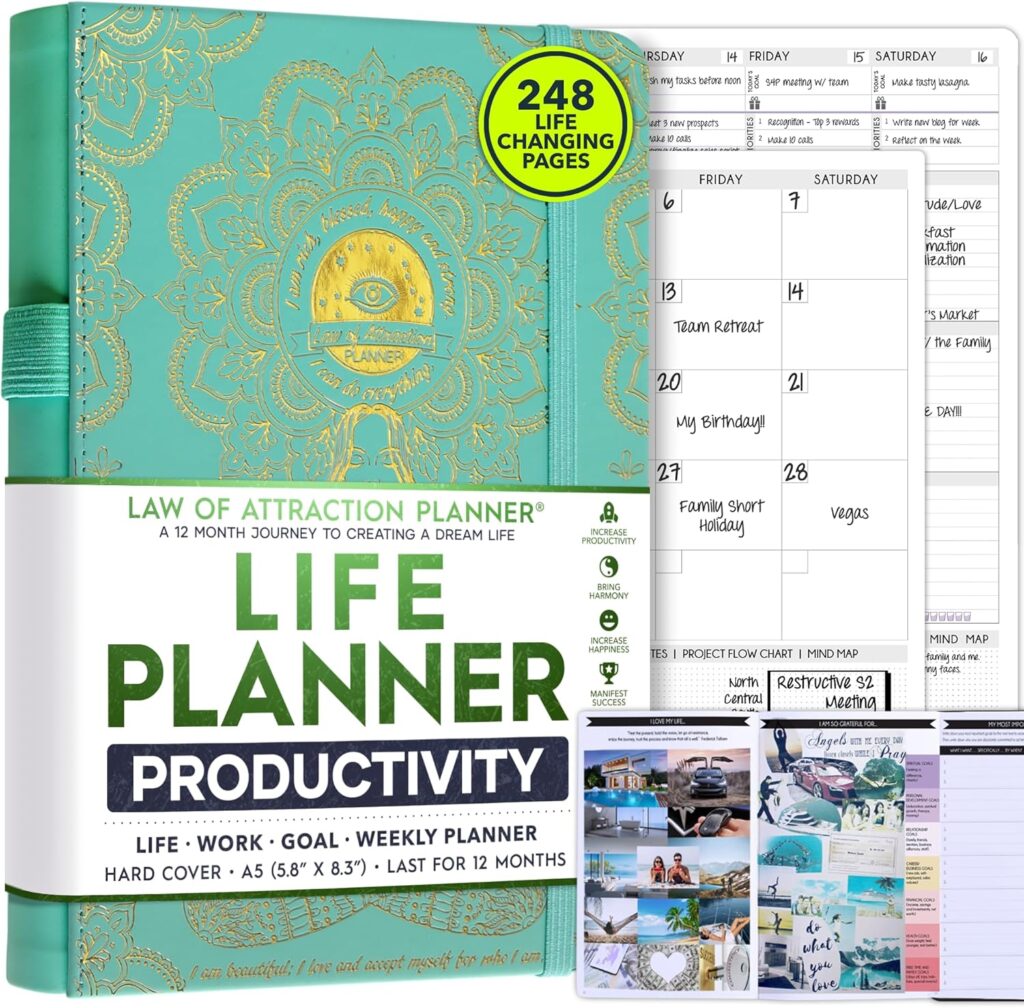

Life Planner – Undated Weekly & Monthly Planner, 12-Month Journey to Increase Productivity | Gratitude Journal, Life Organizer & Goal Journal | Include Foldable Vision Board, Habit Tracker & Stickers

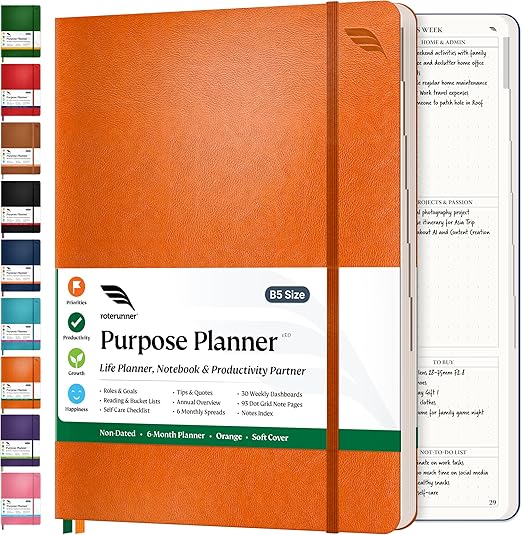

Purpose Planner Undated Monthly Weekly Daily Productivity Journal 2023 Optimised Life, Goal Setting & Business Tool for Academic Student, Professionals, Mums – Leather Day Organiser Notebook

Leave a Reply

You must be logged in to post a comment.