Shifting into thriving mode and leaving behind survival mode often coincides with becoming financially stable. Smart personal finance moves help you move from survival mode to thrive mode and further enables you planning and achieving your dreams. Taking control of your finances improves your physical and mental well-being as well.

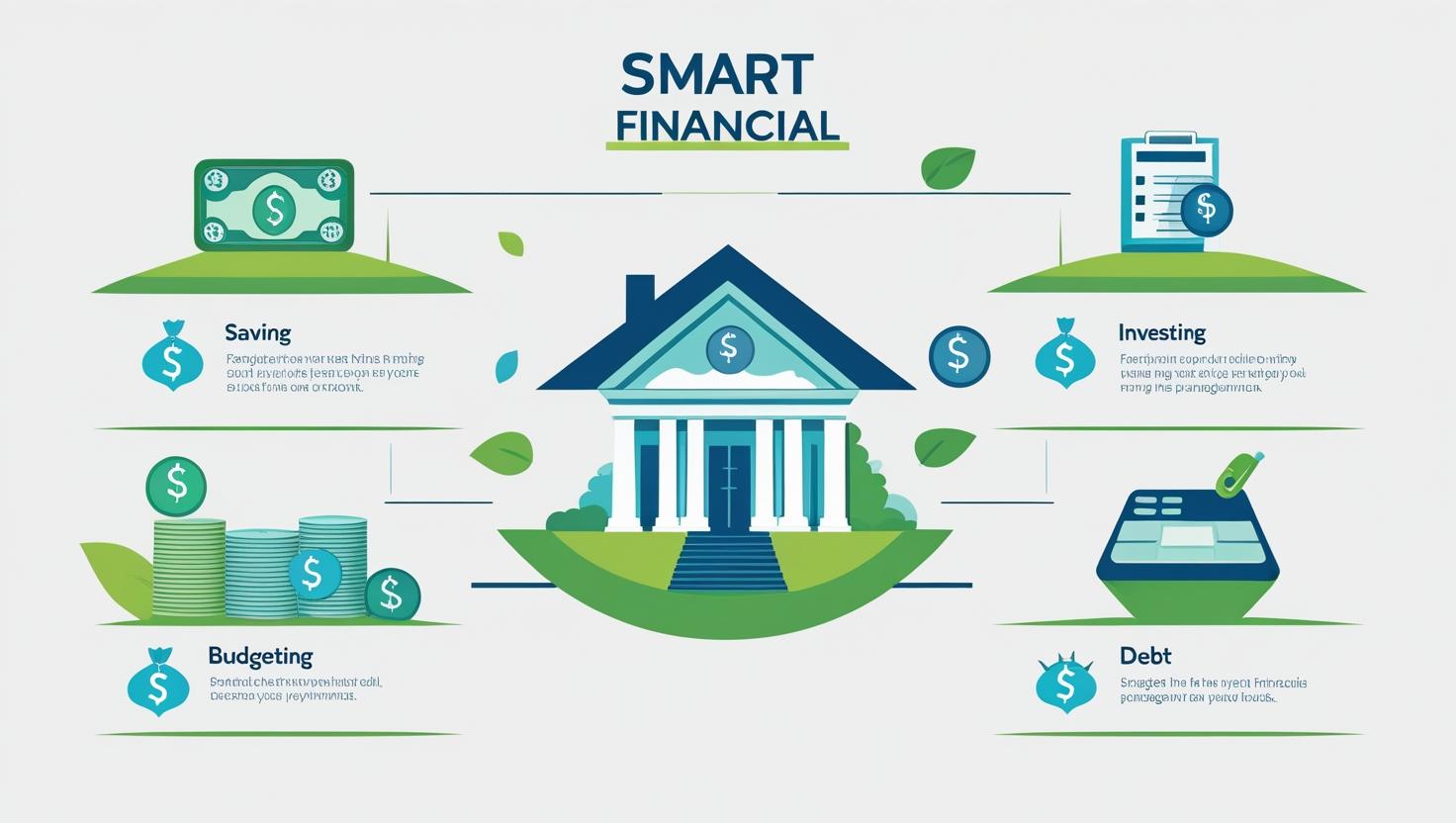

| Personal Finance Aspects |

Budgeting:

The first step in a starting a good financial foundation is to create a budget. It consists of both, tracking your income and your expenses to understand how much of your money you spend where. The benefits of budgeting are it helps you identify areas of overspending, helps you prioritize your financial goals, enables you to see your financial situation clearly.

Saving money is crucial for building a financial safety net and achieving long-term goals. The benefits of saving money are: you have a cushion when unexpected expenses occur, you can wait for the good investment opportunities, it helps you reach your financial goals faster.

| Investing your money wisely should yield returns on investments. The benefits are: a higher rate of return on investments versus generic bank accounts like savings and checking, reaching personal finance goals sooner, diversifies your income streams making you more financially stable. | Managing Debt: Correctly managing your debt accounts enables you to attain and retain a good financial foundation. This is beneficial because you will have less stress, you will be able to free up funds for investments, and your credit score will improve. |

| Future Plans |

Future financial planning involves researching perspective investments, developing financial goals and strategies to achieve financial security. Included activities are insurance planning, estate planning, and deciding on your retirement plan. Later life financial security, protecting your foundation, and gives you peace of mind are benefits of good future planning.

This includes activities such as retirement planning, estate planning, and insurance planning.

| Summary |

Establishing a personal budget is an important step toward financial stability. Everyone should have one, regardless of their income level. This guide will help you identify categories of spending and provide a step-by-step approach to creating a budget that can help you achieve your financial objectives.