Most people use a regular bank savings and or checking account for their personal finances. Other personal financial accounts are available to consumers; each with benefits and drawbacks to each account type. You will have to decide with accounts are best for your wants and or needs.

- Savings accounts are bank accounts frequently used to save money for any financial goals in the future as in a car down payment. Access to savings accounts often limited by the banking institution. Savings accounts are great for funds you want to stash away for any length of time. These are not great if you need frequent access to your account.

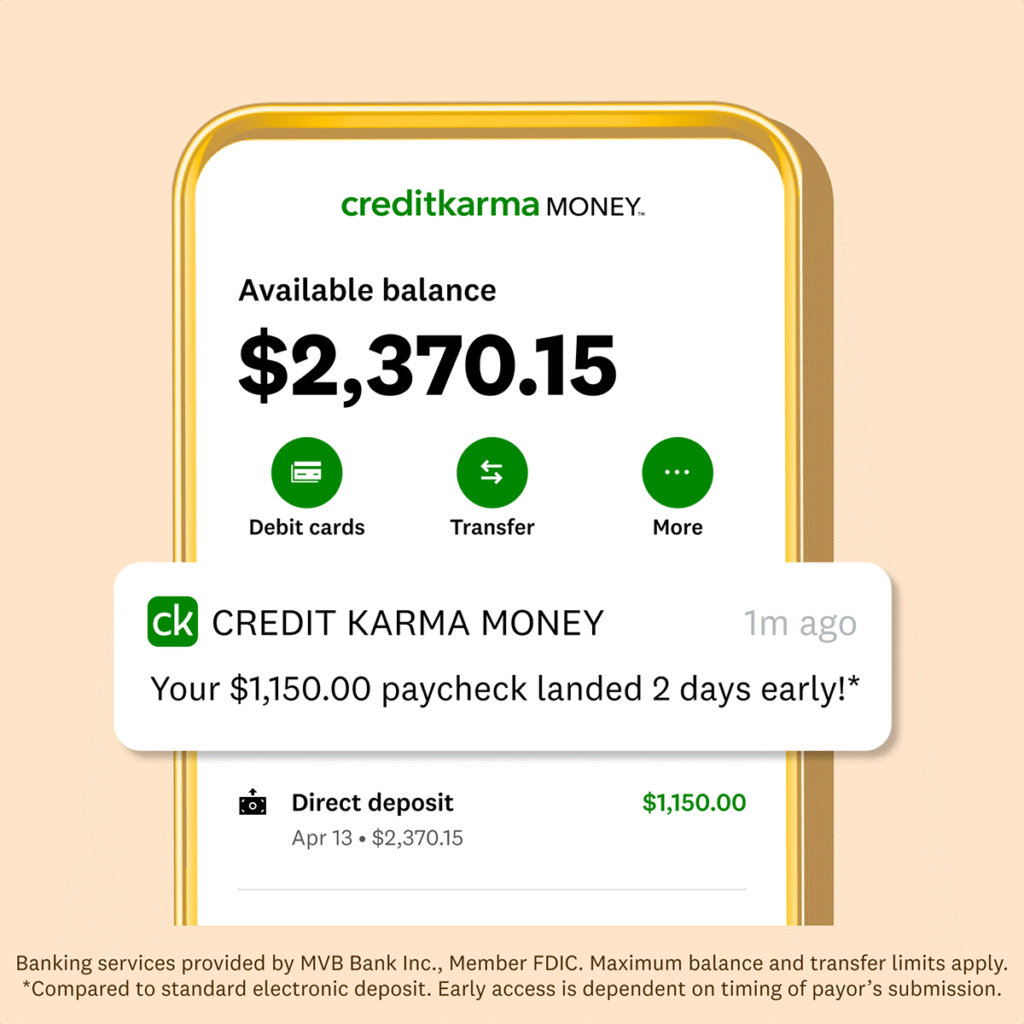

- A Checking Account usually offers easy access to your money through using physical checks or debit cards. This convenience makes checking accounts one of the ideal ways to pay bills and execute your financial goals. It is not the ideal way to accumulate interest from your money, as it were.

- Money Market Accounts are a hybrid account with aspects of checking and savings accounts. However, there are usually limits to the number of monthly withdrawals, like with a savings account. They do offer a higher annual percentage yield, however they do require a minimum balance and limited monthly withdrawals from the account.

- A CD, or Certificate of Deposit gives a higher interest rate on your money, but you have limited access to these funds. If you cash the CD out early, there are early withdrawal penalties.

More information is below about each account type.

Savings Accounts

Most people start a savings account as their first bank account because they often offer minimal amounts to start and may have low amounts to avoid service fees. A savings account is a good means to set money aside for any reason you may have; uses could range from an account for a vacation, weddings, house downpayment, car downpayment among many others. Emergency funds are another good use for this type of account for appliance or other types of repairs. Most savings accounts do pay back a small amount of interest, they often do not pay back high yield interest. There are a few strictly online banks that offer high-yield savings account which is better than a regular savings account. One of the drawbacks to savings accounts is some banks have fees if you make too many transfers or withdrawals. Many do not have debit cards nor checks as part of the restrictions in place.

Checking Accounts

The most user-friendly kind of banking account. Checking accounts are more user friendly with easy access to your money with check writing capabilities and often the option to connect an Automated Teller Machine card or a debit card. These accounts usually have unlimited check writing and a debit card most of the time making them a great way to take care of your daily living expenses. They do have a few drawbacks; they earn no or very little interest. Some banks and credit unions offer interest-bearing checking accounts.

These accounts may charge monthly service fees for monthly maintenance, minimum account balance penalties, and ATM withdrawals. There may be additional fees for using your debit card too many times or to withdraw money too frequently.

Money Market Accounts

A Money Market Account is a hybrid account type that has features of both checking and savings accounts. They offer a high annual percentage yield versus a low percentage yield like some other account types. They require a higher minimum balance be kept in the account. They are available with check writing and debit card privileges but they may limit the number of checks written each month without extra fees.

MMAs are a good financial vehicle to keep a high account balance capable of high interest returns. The access to your funds is limited and a minimum balance is required.

Certificates of Deposit

Certificates of Deposit, or CDs are bank accounts allowing an individual to financially invest in for definite time-period at a fixed interest rate that is a low-risk financial tool. The time length to CD maturity varies from mere months to several years. All kinds of financial goals can benefit from the use of CDs and they often pay higher APYs than other account types. A commitment to keep the money in the account for the duration is a requirement; to avoid penalty fees, Certain banks offer no-penalty CDs, offering lower interest rates in exchange for waived penalties for early withdrawals.

CD’s are good to earn interest at a better rate over other bank accounts in exchange for agreeing to set your money aside for a specified time amount.

In conclusion

Deciding on which kind of bank account or accounts will best fit your financial needs and wants depends on your financial goals and strategies. Which ever choices you make, you will have a better idea which account type or types is best for your situation.

Leave a Reply

You must be logged in to post a comment.